Webinar/Seminar: Clear as Mud – The Status of Independent Contractors in California

There have been many recent changes about the status of independent contractors by California courts and the legislature. Attorney Laura Withrow provides an update on these legal changes to help businesses to correctly categorize these workers

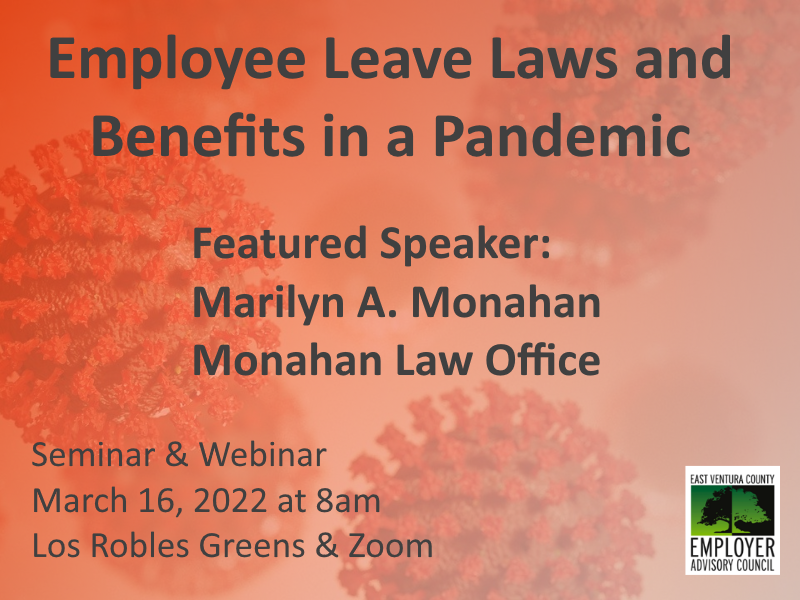

Seminar/Webinar: Employee Leave Laws and Benefits

In our March 2022 seminar, Our featured speaker, attorney Marilyn A. Monahan, will cover employee leave laws that apply during the Covid-19 pandemic and administering benefits under the federal Family and Medical Leave Act (FMLA) and the California Family Rights Act (CFRA)

Seminar/Webinar: Independent Contractors, Workers Comp, the Labor Commissioner, and You

| Speakers: | Chase Fiscus – Fiscus Commercial Insurance Services, Inc. Adam Treiger – Stowell, Zeilenga, Ruth, Vaughn & Treiger LLP |

| Date: | Wednesday, Feb. 16, 2021 |

| Program: | Networking 7:45am – 8:00am |

| Program 8:00am – 9:00am | |

| Location: | In Person: Los Robles Greens Banquet Center, 299 Moorpark Rd., Thousand Oaks, CA 91361

This event will also be presented virtually via Zoom. Zoom link will be emailed after before the event. |

This is a seminar designed to educate business owners, human resources professionals and managers/supervisors on issues related to the problems faced by employers when government agencies assert that an independent contractor should be classified as an employee.

Topics will include:

- Information on workers compensation insurance for independent contractors including obtaining coverage, costs, and how this coverage might fit in your risk strategy.

- What happens if the Labor Commissioner contends an independent contractor should be classified as an employee.

- The arguments available to an employer in the administrative process with the Labor Commissioner and information about the process.

Chase Fiscus is the Founder of Fiscus Commercial Insurance Services, Inc. located in Simi Valley, California. Chase founded FCIS when he was 19 years old — little more than a year after he graduated from high school. Chase’s day-to-day role at FCIS includes negotiating contracts with insurance companies, implementing new business strategies, growing the company and providing the overall vision for FCIS. An outgoing and energetic, yet detail-oriented guy, Chase is passionate about spending time with clients and walking through their businesses and job sites. Chase was born in Thousand Oaks, California, grew up in Moorpark and now lives in the Santa Rosa Valley with his family.

Adam K. Treiger is a law partner in Stowell, Zeilenga, Ruth, Vaughn & Treiger LLP, in Westlake Village, California. Adam concentrates on complex employment and business law counseling and litigation, focusing on wage and hour, discrimination, harassment and wrongful termination issues and disputes, and on handling business agreements, legal entities, and mergers & acquisitions. Adam is a Super Lawyer, a Provisors Group Leader, and an Employer Advisory Council board member.

We have restructured our events to include in person seminar at Los Robles Greens Golf Course and virtual webinar via Zoom. Due to this event taking place indoors, please practice social distancing and wear a mask. Attendance is limited and table seating will be reduced to allow for social distancing. We look forward to seeing you in person and virtually online!

Register here today!

No more time rounding says california court

On February 25, 2021, the California Supreme Court ruled that rounding time entries for meal periods is unlawful, in Donohue v. AMN Services, LLC. In this case, the employer’s electronic timekeeping system rounded employee time punches to the nearest 10-minute increment. The employer believed this policy was lawful under the 2012 California Court of Appeal case of See’s Candy Shops, Inc. v. Superior Court, which held that employers may use rounding for employee’s time punches at the beginning and the end of their shifts as long as (i) the rounding procedure is fair and neutral on its face and (ii) the employer’s rounding over a period of time does not undercompensate employees for time actually worked. But the Supreme Court held that rounding is not appropriate for meal periods given the precise time requirements associated with meal periods.

On February 22, 2021, the United States District Court for the Northern District of California ruled that a wife’s civil lawsuit for personal injury based on her husband becoming infected with Covid-19 at work and subsequently infecting the wife at home was barred because California’s workers’ compensation statutes provide the exclusive remedy to the extent the employer may have any liability for the wife’s alleged harm (Kuciemba et al v. Victory Woodworks, Inc.). One of the issues in the case was “take home liability,” which is liability for employers in tort to family members of employees who injure their families at home due to some sort of toxic contamination suffered by the employee at work. The court did not rule on that issue, but, in holding that workers compensation was the exclusive remedy, the court limited the applicability of “take home liability” in the context of the spread of an infectious disease that may be traceable to the workplace.

–Adam K. Treiger, Esq.